Sarbanes-Oxley Compliance and RFID

RFID can help businesses pass audits and fulfill requirements imposed by the Sarbanes-Oxley act (SOX) – a law that has had drastic operational and financial impacts on U.S. companies.

Background

Nearly twenty years ago, in 2002, the Sarbanes-Oxley Act was created to hold publicly traded companies accountable for their financial reporting.

This came after some of the U.S.’s largest companies were exposed for financial scandal. Unethical business practices and falsified financial statements landed these companies in bankruptcy – evaporating employee’s retirement plans and crumbling investor trust in corporations.1

What is Sarbanes-Oxley?

SOX implemented rigorous controls for financial reporting and auditing. This was done to ensure the accuracy of corporate disclosures, with a hefty criminal charge for non-compliance.

With the creation of SOX, companies quickly made investments in controls that would help them pass audits. However, many continue to underestimate the massive undertaking of accounting for assets and rely on a large workforce and static spreadsheets for reporting.

RFID can revolutionize this process – eliminating human error, showing asset status in real-time and being a reliable source for data.

RFID’s Role in Sarbanes-Oxley Compliance

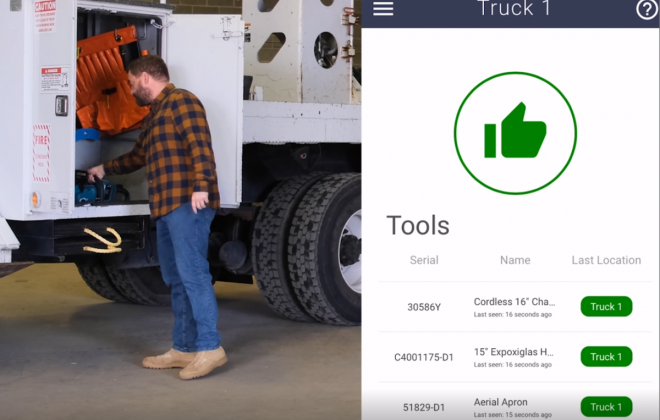

RFID is an efficient, accessible technology that collects data from items (think medical supplies, tools, IT assets and anything in between) and provides real-time reports with item status, history, and location.

RFID can play a critical role in SOX compliance by:

- Increasing Reporting Accuracy:

- SOX Requirement: A company’s financial statements must be accurate to the best of the executive officer’s and chief financial officer’s knowledge.2

- RFID Benefit: Assets play a role on a company’s financial statement – and an inaccurate count can lead to errors in reporting. Manual asset tracking is prone to human error and risks this accuracy. Automating this process with RFID diminishes that possibility as readers collect, organize, and report the data. This ensures that everything is accounted for – which can reduce loss rates by as much as 99%.

- Disclosing in Real-Time:

- SOX Requirement: Section 409 of the Sarbanes-Oxley act requires that material changes in a company’s financial condition or operations are required to disclose the information on an almost real-time basis (within 48 hours).3

- RFID Benefit: Automatic data can capture supplies’ real-time information as readers read the RFID tags. This can be done with continual updates or by passive readers that scan an item any time it passes by (such as entering a new location). Software receives this information and organizes it, then feeds it to the user. Users can even get automated alerts when an item’s information changes.

- Providing Traceable Source Data:

- SOX Requirement: any source data in financial reports must be traceable and any changes documented.4

- RFID: Data pulled from RFID readers is easily viewed. All changes to any assets are recorded and kept with the pertaining asset. This allows users to trace all information and keep it updated as changes occur.

Other Benefits of RFID

RFID’s features directly correlate to the SOX requirements mentioned above – but it has other ways it supports this as well:

- Simple Reporting: RFID makes running reports incredibly easy as data is continuously updated and ready to be pulled at any time. Users can enter the parameters and get up-to-date information within minutes, rather than waiting for a manual count or referencing a previous report.

- ERP Integration: ERP systems are often employed to help with SOX compliance. RFID software, such as ItemAware, can easily integrate with these systems making it easier to share and pull information.

Conclusion

Ensuring that your company is meeting all requirements to Sarbanes-Oxley is crucial, and RFID can make that process easier.

Index

- https://www.investopedia.com/terms/s/sarbanesoxleyact.asp

- https://isgovern.com/blog/sox-compliance-act-and-public-funding-financial-reporting/

- https://www.sec.gov/news/press/2003-6.htm

- https://learnidentityandaccessmanagement.com/sox-compliance/

About the Author

Elyse Cheatwood is our Marketing Manager. With ten years in marketing and ever-increasing knowledge of the Automated Identification Data Collection (AIDC) industry, she creates research-driven content based on market trends, industry updates and tech insights from reputable sources (including the professionals she works alongside).

Categories

- Awards (1)

- Cellular GPS (1)

- Compliance (3)

- Events (4)

- Features (2)

- Inventory Management (4)

- Item Management (4)

- ItemAware (14)

- News (3)

- Quality (1)

- RFID (8)

- RTLS (5)

- Software (8)

- Traceability (4)

- Uncategorized (2)